|

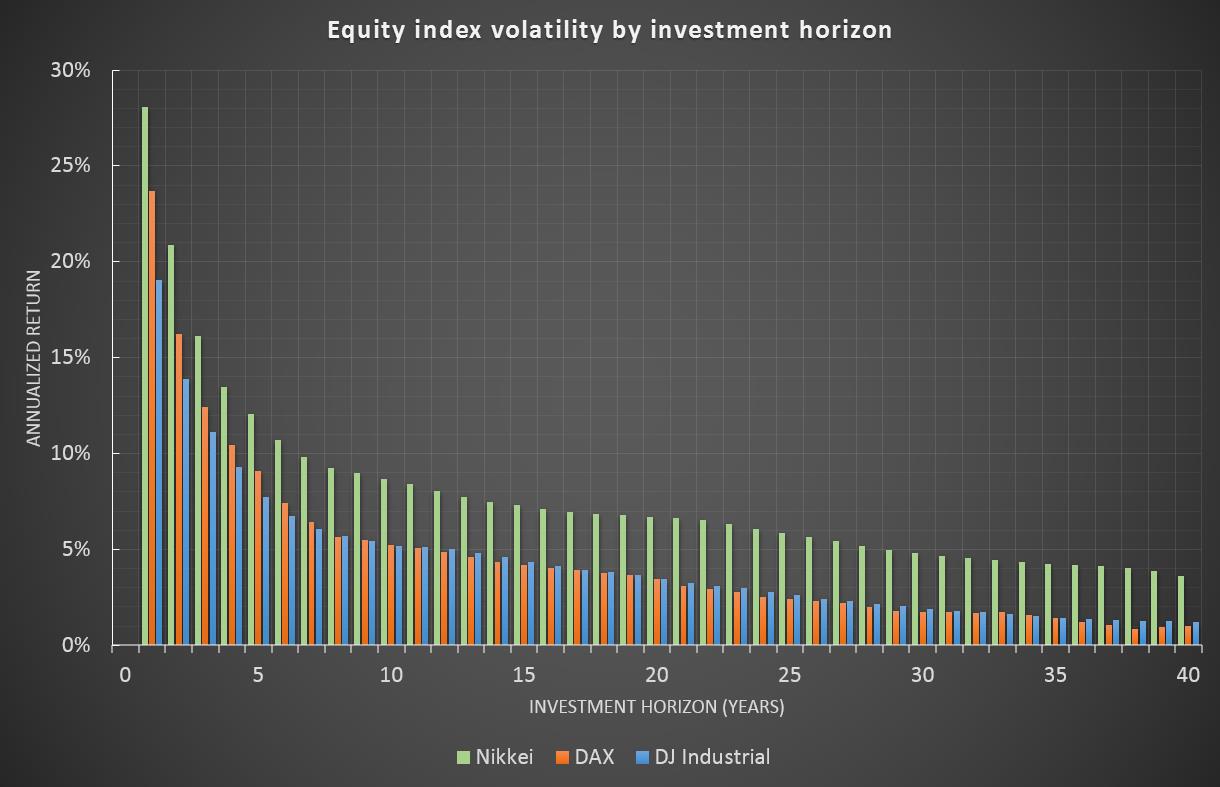

Abstract Is there a way to invest in the equity market with a realized volatility of less than 2%? What sounds impossible from a first point of view has contrarily to be considered common knowledge. Though, the underlying relation has not often been stated in a formal way. It is as simple as this, look at your investment horizon. Equities are said to have a volatility of around 20%. This is a misleading information since the risk measure volatility does not consider the investment horizon of an investor or a specific strategy. An investor who is planning to redeem his money after one year could consider the volatility on his return to be around 20%. On the other hand, a 30-year old investor planning to save for his pension would overestimate the risks in his equity investment if he would not count for the long holding period. In this analysis, the impact of the investment horizon on the volatility and return of an equity investment is revealed. Setup For this analysis three different equity markets will be covered. To cover different global regions, one index is picked to reflect the regions USA, Europe and Asia. a. Dow Jones Industrial Average Price Index (1929-2016) (ex dividends) b. German DAX Total Return Index (1959-2016) (inclusive dividends) c. Japanese Nikkei Price Index (1949-2016) (ex dividends)

Conclusion

What consequence should be derived from these results? An investor has to be very careful in applying risk measures. Standard measures like volatility are not reflecting the investment horizon of an investor. Consequence might be, that the risk appetite is underestimated which would lead to a higher weight of cash or bonds. This allocation, which would normally be considered as a more "risk averse" one, might turn out to be a strategy which in fact increases a more severe but hidden risk for longer investment periods - inflation. Therefore, in all circumstances, investors should always account for their investment horizon. In case of volatility this could be done not only with using a qualitative approach to increase the equity weight for longer horizons by a rule of thumb but with taking into account loss taking capability on a given investment horizon adjusted on a base of x-years-volatility.

1 Comment

|

AuthorBertan Gueler, CFA Archives

July 2019

Categories

All

|

RSS Feed

RSS Feed