Historic Stock Market Crashs - How often did the S&P 500 crash and how much did it lose?

How to define a stock market crash?

A stock market crash can be defined differently but all such events have one thing in common - losses.

In addition to the so-called flash crashes, in which losses often occur instantaneously within one day and are then typically corrected again, it is particularly the longer-term loss periods during which loss magnitudes of -40% to over -70% can be observed.

A stock market crash can be defined differently but all such events have one thing in common - losses.

In addition to the so-called flash crashes, in which losses often occur instantaneously within one day and are then typically corrected again, it is particularly the longer-term loss periods during which loss magnitudes of -40% to over -70% can be observed.

|

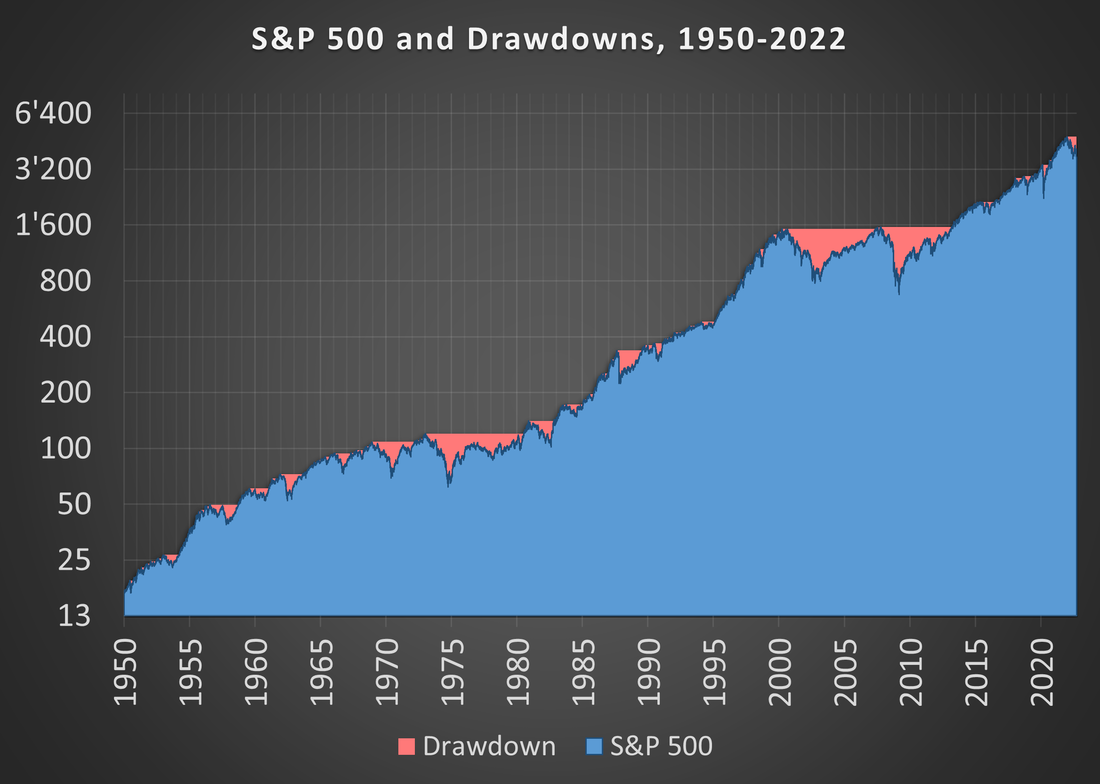

The chart of the S&P 500 from 1950 to 2022 shows, that periods of rising prices and crash periods alternate.

From 1950 to 1970 the S&P 500 gained continuously with smaller loss periods. During the 1970s the S&P 500 moved sidewards with longer loss periods throughout the decade. From 1980 to 2000 the S&P 500 had its strongst period with only few short-term loss periods with small loss magnitudes. The decade from 2000 to 2010 showed two major loss periods and a non-trending S&P 500. Thereafter, the index again showed a very strong performance until recently. |

How worse can it get during crash periods?

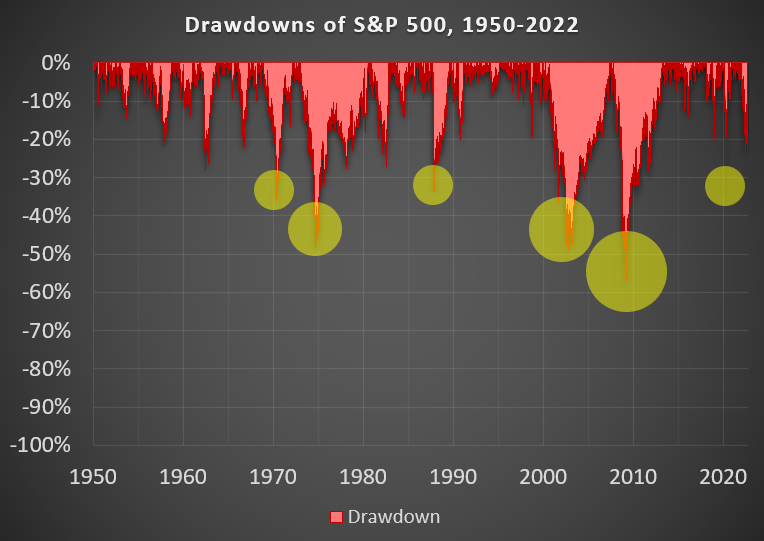

The following chart illustrates the severeness of the loss periods during which the S&P 500 accumulated losses.

The following chart illustrates the severeness of the loss periods during which the S&P 500 accumulated losses.

|

This chart emphasizes the periods in which losses accumulated for almost -40% or more.

None in the 1950s None in the 1960s 2x in the 1970s 1x in the 1980s None in the 1990s 2x in the 2000s None in the 2010s 1x in the 2020s In total, 6 such periods have happened in the last 72 years, almost once every decade. Nevertheless, there have been long periods without any crash event while during others it happened more frequently. |

Conclusion

A crash of -40% and more does not happen very often in the S&P 500, but on average it happens once in a decade.

The magnitude of the losses during these crash periods often reaches up to -40%. In more severe crashes like in 1974, 2003 or 2008, the losses accounted for even -50% to -60%.

Every stock market investor should be prepared for such crash events since they will very likely happen several times during a lifetime.

A crash of -40% and more does not happen very often in the S&P 500, but on average it happens once in a decade.

The magnitude of the losses during these crash periods often reaches up to -40%. In more severe crashes like in 1974, 2003 or 2008, the losses accounted for even -50% to -60%.

Every stock market investor should be prepared for such crash events since they will very likely happen several times during a lifetime.