How miserable is the DAX start to 2016 in historical comparison?

The DAX started the new year with a minus of 8.3%. But how bad is the start of 2016 in a historical comparison?

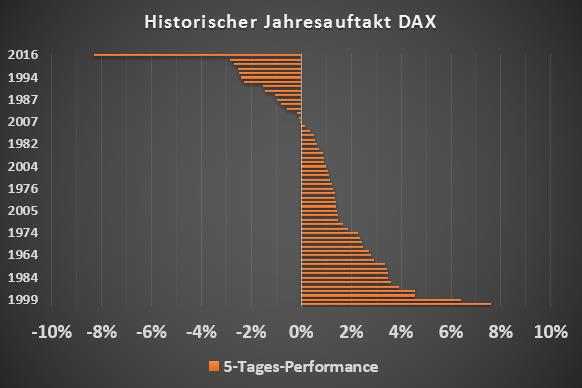

Here is a comparison of all the performances of the DAX that the index has achieved since 1960 in the first five days of a year.

Here is a comparison of all the performances of the DAX that the index has achieved since 1960 in the first five days of a year.

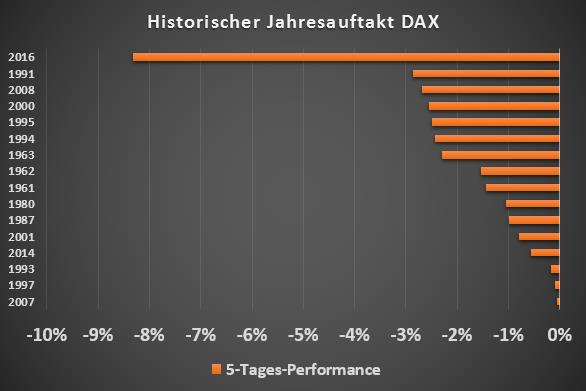

The first picture shows all 5-day performances, while the second picture only shows the years with a negative start to the year.

And you can see that 2016 was the worst start to the year for the DAX in its history. And that's not all: with -8.3%, 1991 was almost beaten by a factor of 3 with the previous negative record of -2.9%. If you look at the individual years with higher negative initial yields, 2016 would add up to years like 1994, 2008 or 2000. All of these are years that most investors should not have the best memories of.

And you can see that 2016 was the worst start to the year for the DAX in its history. And that's not all: with -8.3%, 1991 was almost beaten by a factor of 3 with the previous negative record of -2.9%. If you look at the individual years with higher negative initial yields, 2016 would add up to years like 1994, 2008 or 2000. All of these are years that most investors should not have the best memories of.

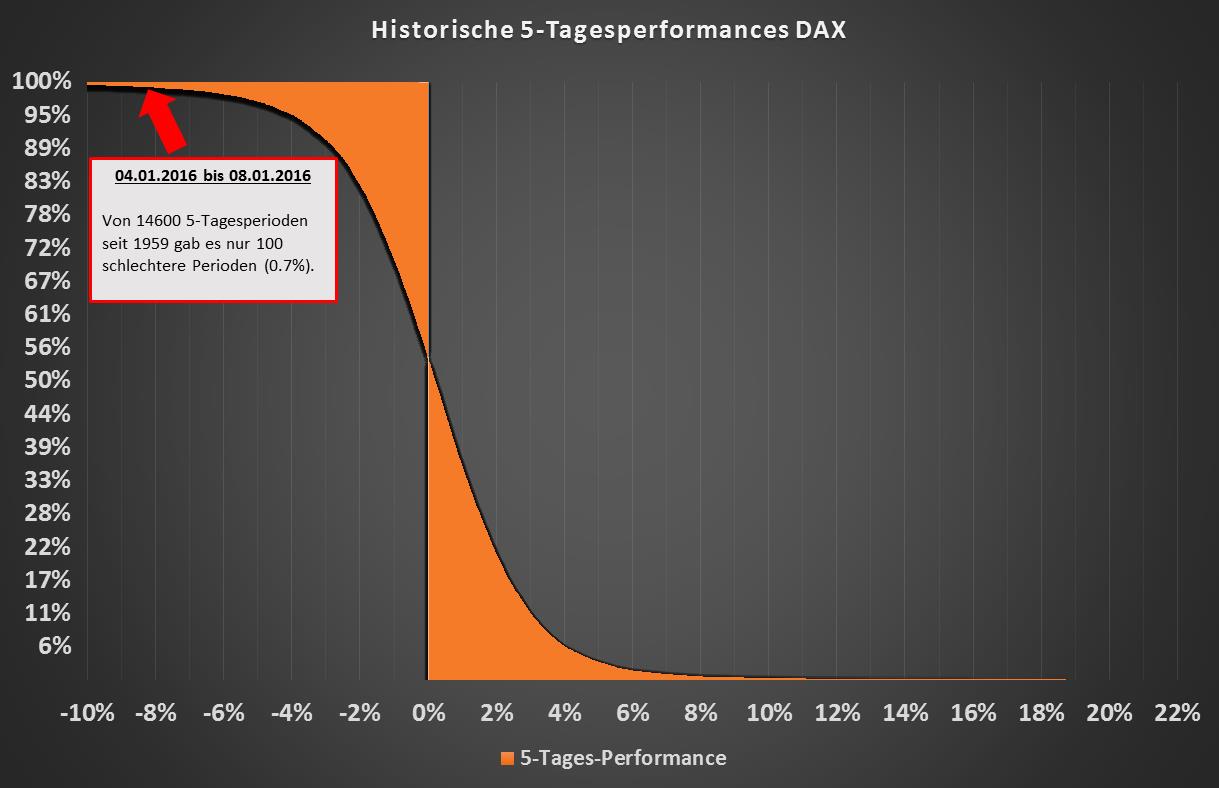

Even in an overall historical context, the start of 2016 is an extraordinary event. From around 14600 (overlapping) 5-day periods, there have only been 100 since 1959 in which the DAX has suffered more than it currently does. This corresponds to a historic 0.7% quantile event.

|

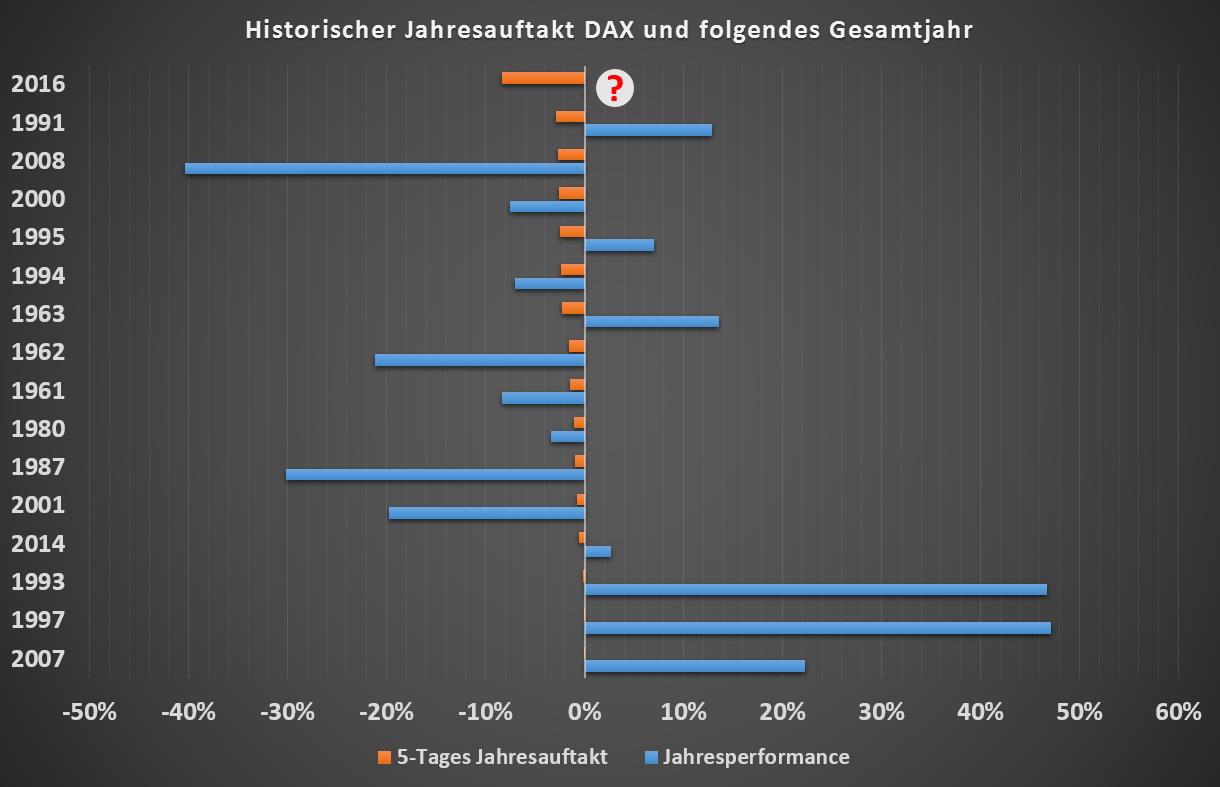

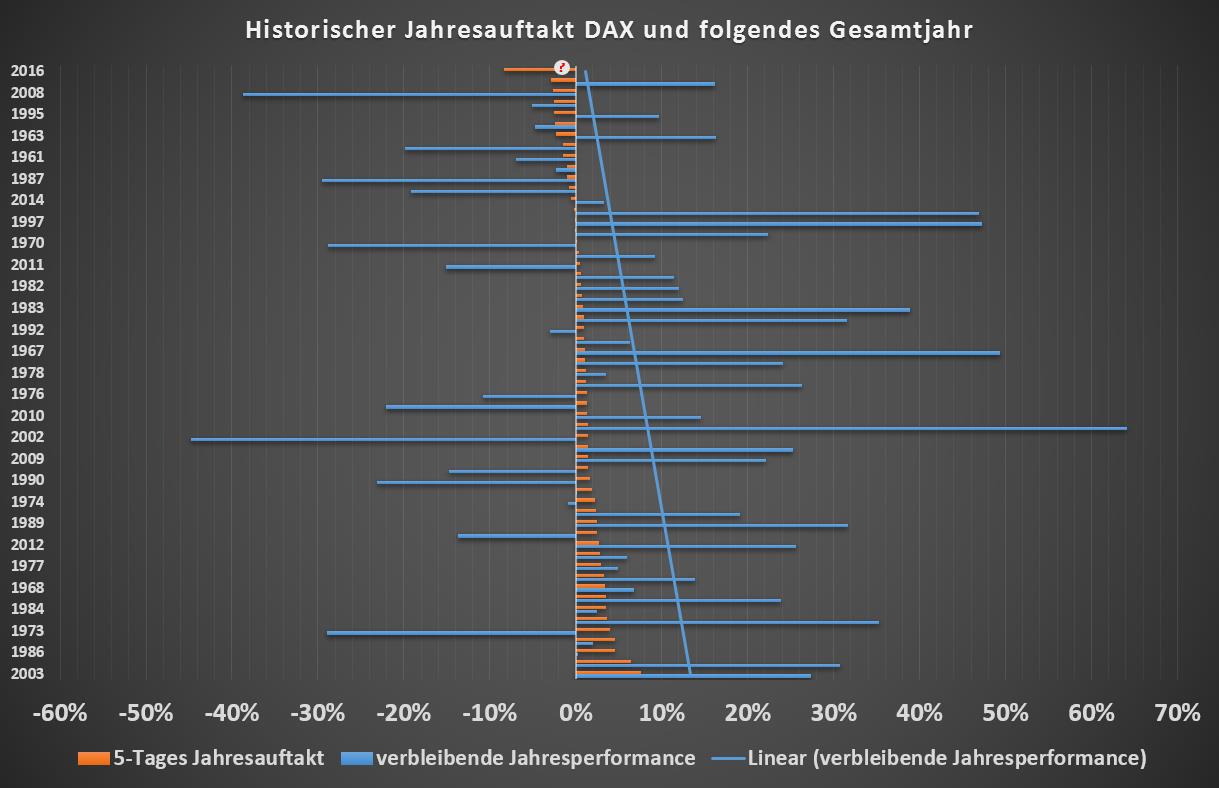

Finally, a chart to answer the question of how the start of the year affects the remaining full-year performance.

It is noticeable that in the years with a negative start, the remaining annual performance tends to be lower. Larger crashes in the remaining year, however, are spread across the entire spectrum of the annual start-up returns. The linear trend line shows that a negative start to the year should be at least more pessimistic for the remaining year. |

Conclusion

Even if a negative start to the year does not necessarily result in a further negative annual development, in the past it has tended to be a sign of weaker market development. However, it cannot be interpreted as a harbinger of a crash year. Really high annual losses appear historically regardless of what the index does in the first week of the year.

Even if a negative start to the year does not necessarily result in a further negative annual development, in the past it has tended to be a sign of weaker market development. However, it cannot be interpreted as a harbinger of a crash year. Really high annual losses appear historically regardless of what the index does in the first week of the year.