Can you get rich with stocks?

Yes, you can get rich with stocks. Success depends on three key factors, the invested capital, the return on investment and time. For all three factors, the more of these factors you have available, the faster you will reach your goal.

Only by investing in the broad stock market you can achieve long-term returns of 7-10% per year. This is already sufficient to become a millionaire in the course of a lifetime. Anyone who starts saving at the age of 17 can become a millionaire with a savings plan of 100 to 200 USD per month until they retire at the age of 67. Anyone who has 10'000 USD at their disposal at the age of 17 and invests it for 50 years with a return of 10% can also achieve the goal of becoming a millionaire.

Only by investing in the broad stock market you can achieve long-term returns of 7-10% per year. This is already sufficient to become a millionaire in the course of a lifetime. Anyone who starts saving at the age of 17 can become a millionaire with a savings plan of 100 to 200 USD per month until they retire at the age of 67. Anyone who has 10'000 USD at their disposal at the age of 17 and invests it for 50 years with a return of 10% can also achieve the goal of becoming a millionaire.

How much investment capital do you need to become a millionaire?

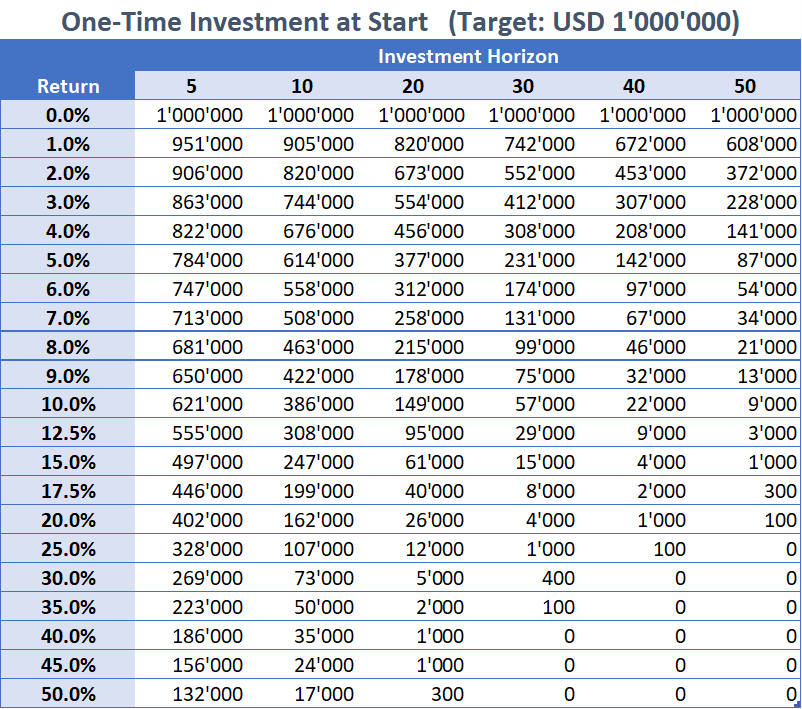

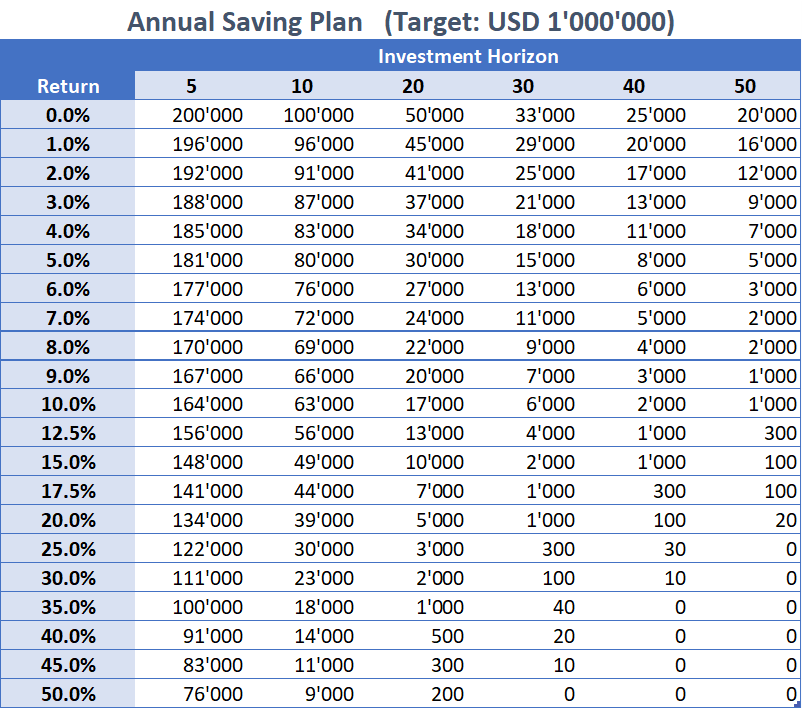

The two tables show what investment amount is required to become a millionaire with different maturities and different returns. With an investment horizon of 50 years and a return of 7.0%, an initial investment of USD 34'000 or an annual savings plan of USD 2'000 (about USD 167 per month) is sufficient.

The figures show that it is already possible to become a millionaire by investing in the pure stock market.

If you can invest in securities that can achieve a return of 20% per year, a one-time investment of USD 100 would be sufficient for a term of 50 years. If you are in a hurry and want to become a millionaire in just 20 years, you need USD 26'000 as a one-time investment or USD 5'000 annually, or a mix of both (USD 13'000 one-time and USD 2'500 annually for example).

If you can invest in securities that can achieve a return of 20% per year, a one-time investment of USD 100 would be sufficient for a term of 50 years. If you are in a hurry and want to become a millionaire in just 20 years, you need USD 26'000 as a one-time investment or USD 5'000 annually, or a mix of both (USD 13'000 one-time and USD 2'500 annually for example).

Think in buckets when it comes to investment - Behavioural Portfolio Theory

In contrast to the classic portfolio theory, in which investment decisions are always considered universally across the entire wealth, the behavioral portfolio theory is based on the assumption that people classify their financial decisions into so-called buckets. For example, one pot is used for pensions, another for the children's schooling, and another for the possibility of extraordinary returns. Personally, I think such a concept is closer to reality and also more practical than an overall portfolio compilation with various secondary conditions.

In general, there are three pots:

Monthly income, bank deposits, life insurance and alike would be found in Pot 1. Fund and share savings plans in pot 2. Speculative financial products such as some wikifolios, lotteries, participation in young companies and alike would be in pot 3.

In general, there are three pots:

- Safety pot => livelihood, basic needs, minimum pension requirements, schooling for children, health, ...

- Growth pot => asset accumulation, additional funds to increase the financial scope for 1.) in the long term, consumption, ...

- Speculation pot => chances with possible total loss but the possibility to get rich.

Monthly income, bank deposits, life insurance and alike would be found in Pot 1. Fund and share savings plans in pot 2. Speculative financial products such as some wikifolios, lotteries, participation in young companies and alike would be in pot 3.

How to invest in the stock market?

You can benefit from the stock market by buying the shares of individual companies directly, for example. This requires some experience of analyzing companies or trading stocks, so it should be seen as an option for more experienced investors. For beginners, but also for professionals, there is the possibility to buy Funds or ETFs (Exchange Traded Funds) issued by professional investment companies. In this way, you can buy a bundle of companies in one go with one transaction and diversify the risk of losses, which is very high when buying just a single stock. There is a wide range of Funds and ETFs on stock indices that are repeatedly mentioned in the media, such as the S&P 500 or Nasdaq 100. An investment in a S&P 500 Fund means participating in the development of the 500 largest companies, an investment in the Nasdaq 100 allows investors to participate in the development of the 100 largest US technological companies.

Where to buy stocks?

The prerequisite is the opening of a securities account with a broker, bank or insurance company. The range of providers is numerous and there is no clear answer as to which provider is the best. This primarily depends on your own needs, such as your own trading activity, how much time you want to spend with the financial markets, the investment horizon, security needs, need for support and advice, and much more. In general, classic banks or insurers are more expensive compared to specialized brokers, but this does not have to be an exclusion criterion in individual cases.

Where can I buy saving plans?

Mutual fund and share savings plans can be set up at most banks or brokers. The available range of savings plans and the costs differ enormously. Before you choose the broker, you should be clear about the form in which you want to invest and which investment strategies and regions you are interested in. Only then can you compare the diverse range of banks and brokers according to your needs.

What are the costs with saving plans?

Especially because of the numerous possibilities to raise costs, a comparison of providers is usually difficult and depends on personal preferences. Clearly visible costs are the account fees, the transaction fees when buying and selling securities and, in the case of funds or ETFs, the management fees of the fund company. Less easily recognizable costs are the price spreads when buying and selling securities, fees that are incurred at Fund and ETF level and are not included in the management fee, and in the case of securities that are traded in a foreign currency, the fees when changing currencies . There can be many other costs, such as deposit statements, order cancellations or the creation of reports.

Should I buy single stocks or mutual funds or ETFs?

Anyone who selects and buys shares themselves saves fees at fund level and is initially better off as a result. Even 1% additional return per year can make a big difference with long investment horizons. Especially with long investment horizons, investing in individual stocks you have selected yourself also entails high risks. Over periods of 30 to 50 years there are serious shifts in the stock market, think for example of Kodak, Nokia, Pan Am, Polaroid or most recently Wirecard. The advantage of funds is that stock portfolios are rebalanced automatically there, whereas you have to do this yourself when you purchase individual stocks. For most investors, a savings plan with funds is the better alternative. Those who actively follow the stock market and also trade themselves can also trade in individual stocks. Anyone who develops a particularly good feeling for stocks can achieve even greater wealth in the long term by selecting individual stocks themselves. However, for most investors, even most professional investors, it's hard to beat the broader stock market with a higher yield over the long term.

The question of whether funds or individual shares does not have to be understood as an "either ... or" alternative. Of course you can choose both forms at the same time for your savings.

The question of whether funds or individual shares does not have to be understood as an "either ... or" alternative. Of course you can choose both forms at the same time for your savings.

Which Fund or ETF for a saving plan?

This question depends on personal preference. If you want to invest in the stock market and can also cope with phases with high losses, you can consider an equity world Fund or ETF as a savings plan as a starting point. Especially for investors with little experience or for those who do not want to devote much time to the financial markets, such very broad products are a good opportunity to benefit from the development of the global market with minimal effort.

In addition to the broad global stock market, there are numerous ways to incorporate your own wishes into the selection. In addition to regional and country-specific products, you can also invest in medium-sized or small-sized companies. In recent years, some scientifically proven strategies have also been made available to most investors in the form of ETFs. Such strategies can, for example, favor so-called value stocks. The best-known value investor is probably Warren Buffet, who for many years was the richest person in the world together with Bill Gates. Momentum strategies have also proven to be a successful strategy over many years and in many asset classes.

In addition to the broad global stock market, there are numerous ways to incorporate your own wishes into the selection. In addition to regional and country-specific products, you can also invest in medium-sized or small-sized companies. In recent years, some scientifically proven strategies have also been made available to most investors in the form of ETFs. Such strategies can, for example, favor so-called value stocks. The best-known value investor is probably Warren Buffet, who for many years was the richest person in the world together with Bill Gates. Momentum strategies have also proven to be a successful strategy over many years and in many asset classes.

What are the risks of saving plans?

The risks are similar to those of individual stocks, but much easier to manage. There are very few Fund products that have a lifespan of several decades. However, the particularly cheap exchange-traded ETFs have only been around since this century, so some popular ETFs are likely to survive the next 50 years. When it comes to individual stocks, it is rightly said that one should diversify. In other words, don't put all your eggs in one basket. The same applies to Fund/ETF savings plans. It is certainly not a mistake if, for example, you open an equity world savings plan with different providers.

It is also advisable not to use just one securities account for the entire term. In most cases, securities are not affected by a broker's insolvency, since the broker's own securities account must be held in so-called separated accounts of the broker and can simply be transferred to another provider in the event of insolvency. How easy it really is in practice has to be seen if it happens. Therefore, you are best advised to also diversify your brokers.

It is also advisable not to use just one securities account for the entire term. In most cases, securities are not affected by a broker's insolvency, since the broker's own securities account must be held in so-called separated accounts of the broker and can simply be transferred to another provider in the event of insolvency. How easy it really is in practice has to be seen if it happens. Therefore, you are best advised to also diversify your brokers.

Step-by-step guide to invest in single stocks or saving plans

- Open a securities account with a broker or bank.

- Transfer the amount to be invested to the account or set up a regular savings plan, which automatically transfers new amounts to the account.

- Select your stocks, products, Funds or ETFs that you consider worth investing in.

- For individual stocks, products or Funds/ETFs, invest the desired amount in the respective title.

- With a savings plan, the broker ideally offers automated execution with which the transferred amounts are invested in the desired securities.

- Let it run, according to the german stock market legend André Kostolany, you should now buy a sleeping pill and look back at the account in many years to realize that you got rich.

Repeat steps 1-6 at other banks or brokers in order to be able to sleep more easily in the event of a provider's insolvency. Ideally, also select other stocks, products, Funds and ETFs from the new broker.

By diversifying your brokers and investments, it is easy to associate each one with one of your target buckets (safety, growth, speculative).