Cross-generational pension plan

If grandparents (would) have saved for their grandchildrens pension

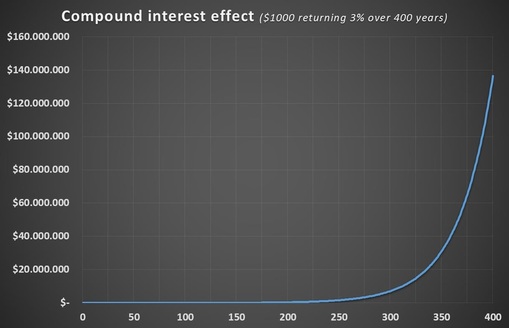

Compound interest effect

Privat pension planning

Many people might have experienced an insurance sales agent who challenged one by mentioning the importance of an early planning of one's pension. Even though this agent might annoy at this moment, his warning is absolutely correct.

Assuming that in all following examples the objective of Max is to achieve an additional $1000 monthly pension at the age of 67. How much does hehave to save per month to achieve that goal? A real return of 3% annually is assumed, which means 3% above inflation.

Assuming that in all following examples the objective of Max is to achieve an additional $1000 monthly pension at the age of 67. How much does hehave to save per month to achieve that goal? A real return of 3% annually is assumed, which means 3% above inflation.

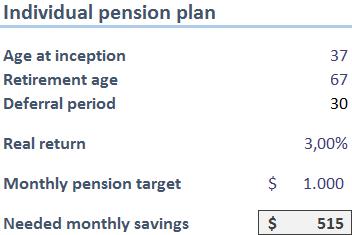

Example 1

Max starts at the age 37 to save for his own pension.

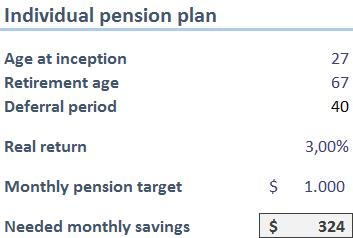

Example 2

Max starts at the age of 27 to save for his own pension.

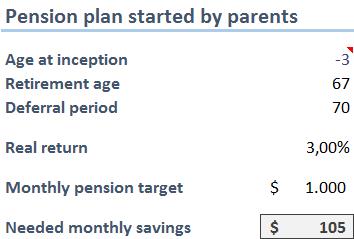

Example 3

Max' parents start to save for his pension 3 years before he is born.

Example 4

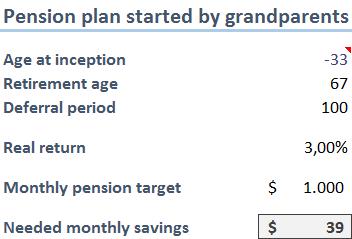

Max' grandparents start to save for his pension 33 years before he is born.

Max starts at the age 37 to save for his own pension.

Example 2

Max starts at the age of 27 to save for his own pension.

Example 3

Max' parents start to save for his pension 3 years before he is born.

Example 4

Max' grandparents start to save for his pension 33 years before he is born.

Conclusion

The importance of the compound interest effect in pension planning should not be underestimated. Indeed, it is so important that it should be the main aspect to focus on. Having missed ten years of saving between the age of 27 and 37 will lead to $515 monthly savings instead of $324 in order to achieve an extra $1000 pension at the age of 67. If Max' parents would have started this saving plan 3 years before hewas born, Max would just have to take over a $100 saving plan to achieve hisgoal. He could be really happy if his grandparents would have started this plan 33 years before he was born. In this case, he would only have to take over a $39 saving plan to achieve his additional $1000 pension.