Backtests Crash Protection-Strategy

|

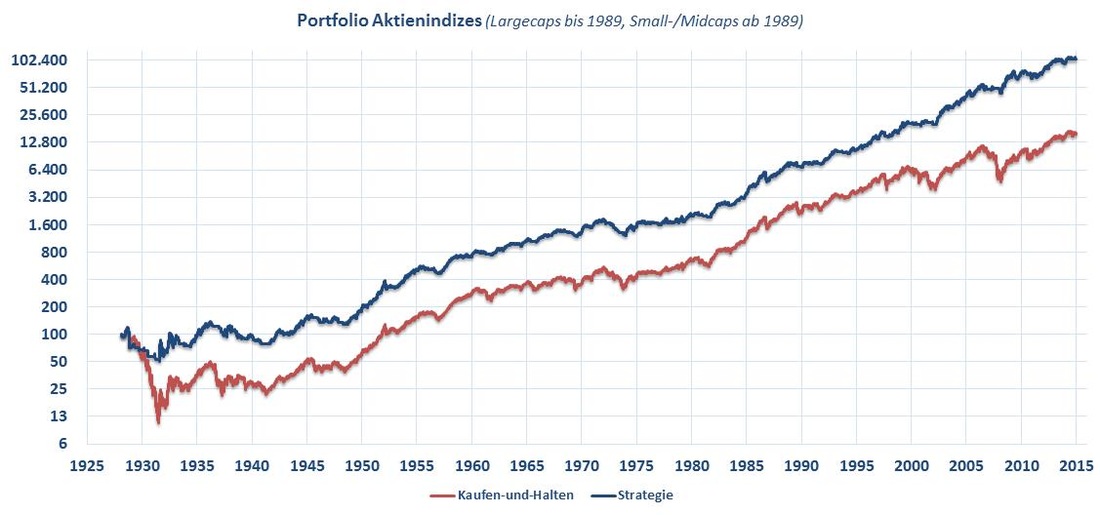

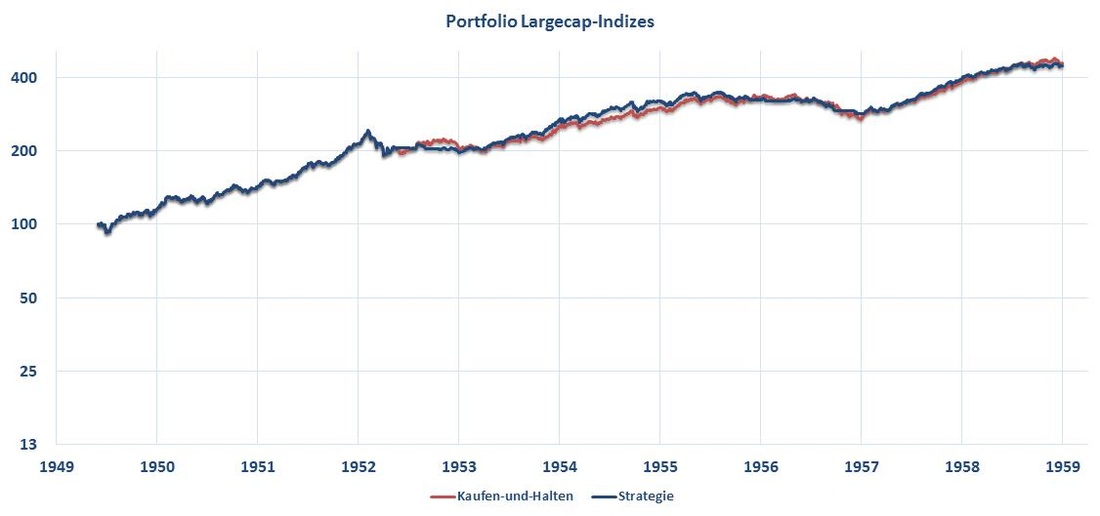

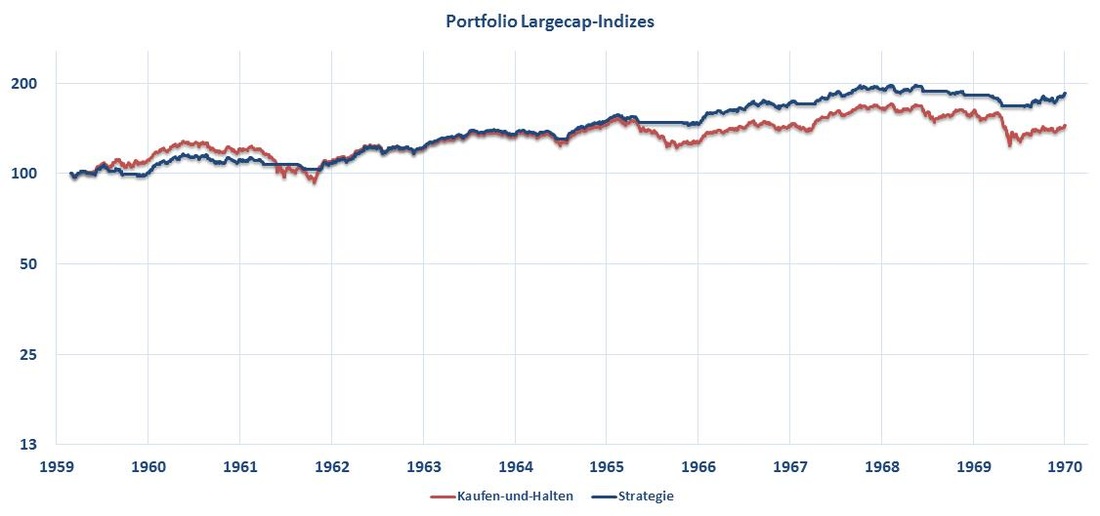

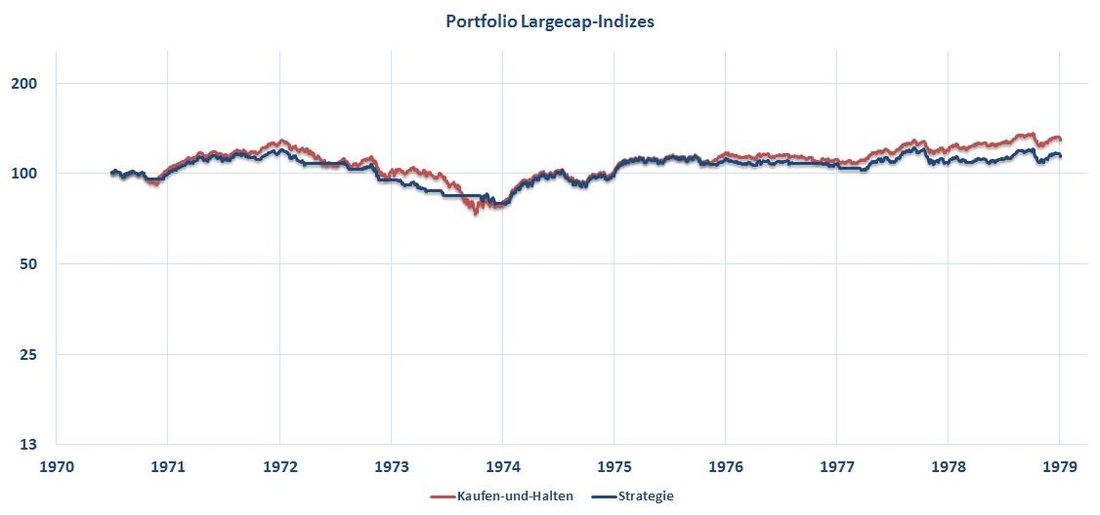

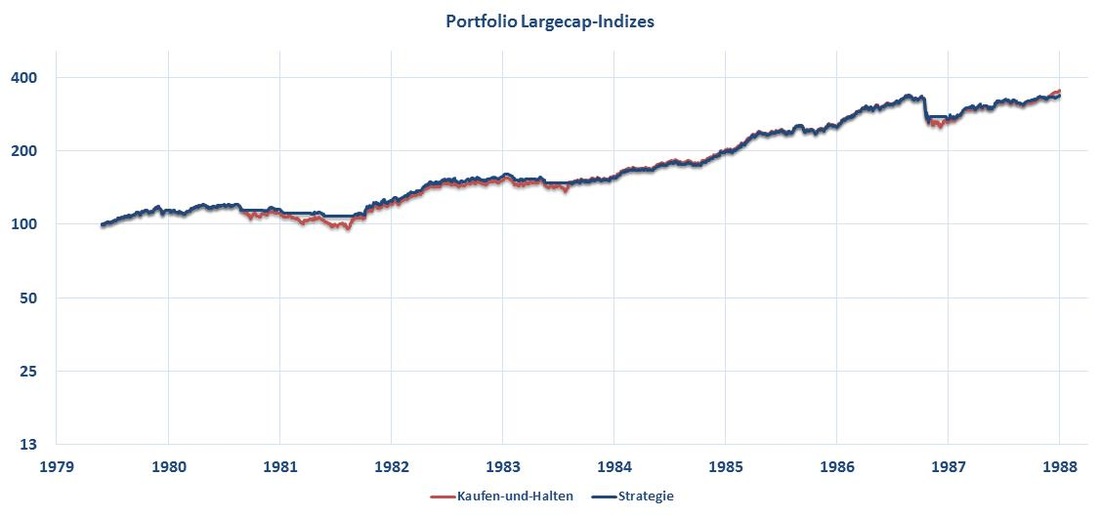

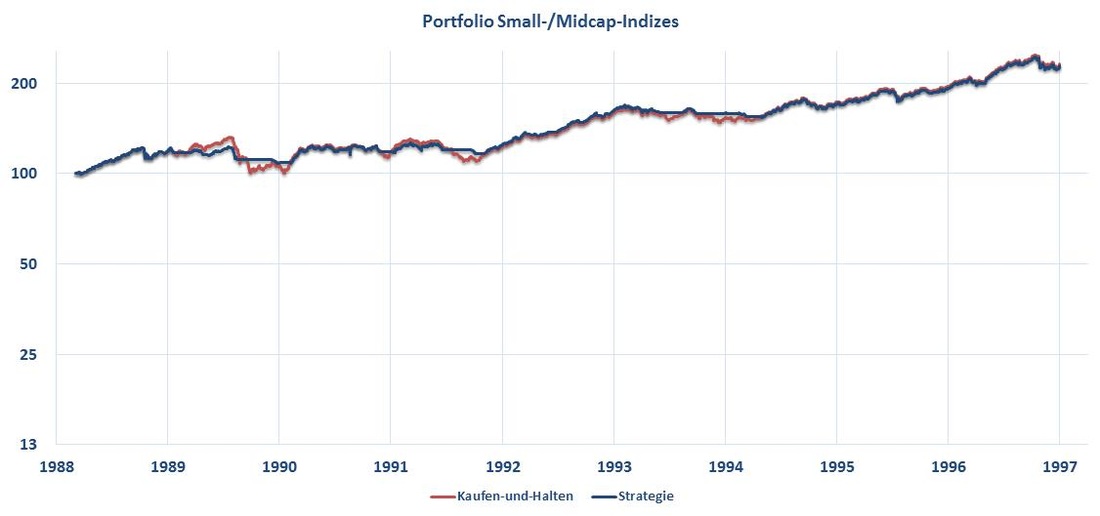

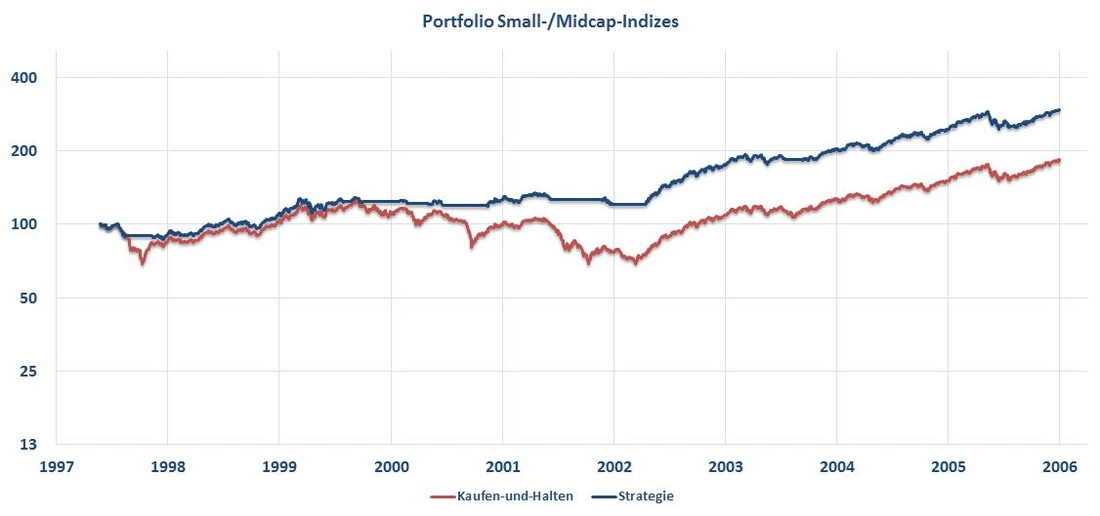

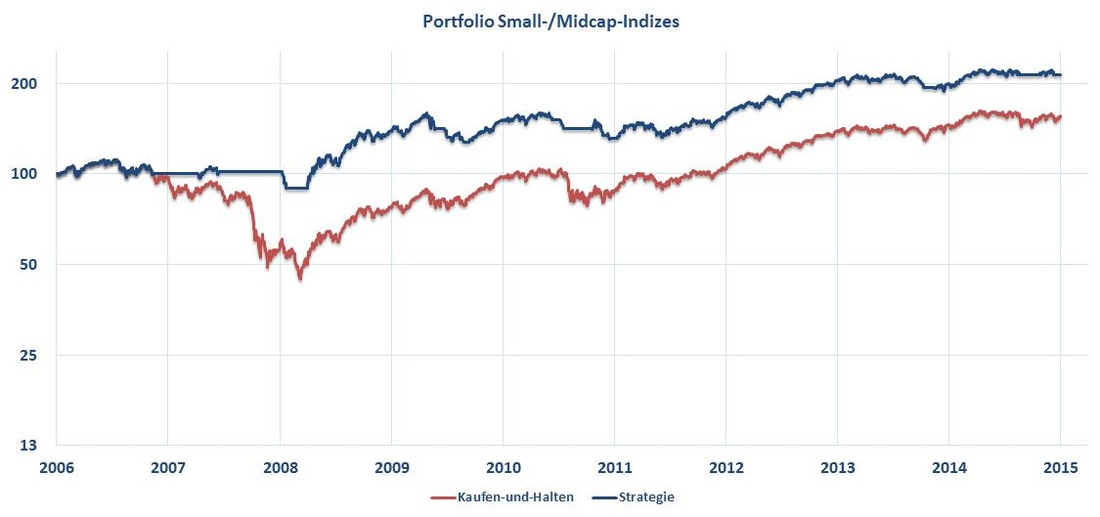

Results during multi-decade-long periods

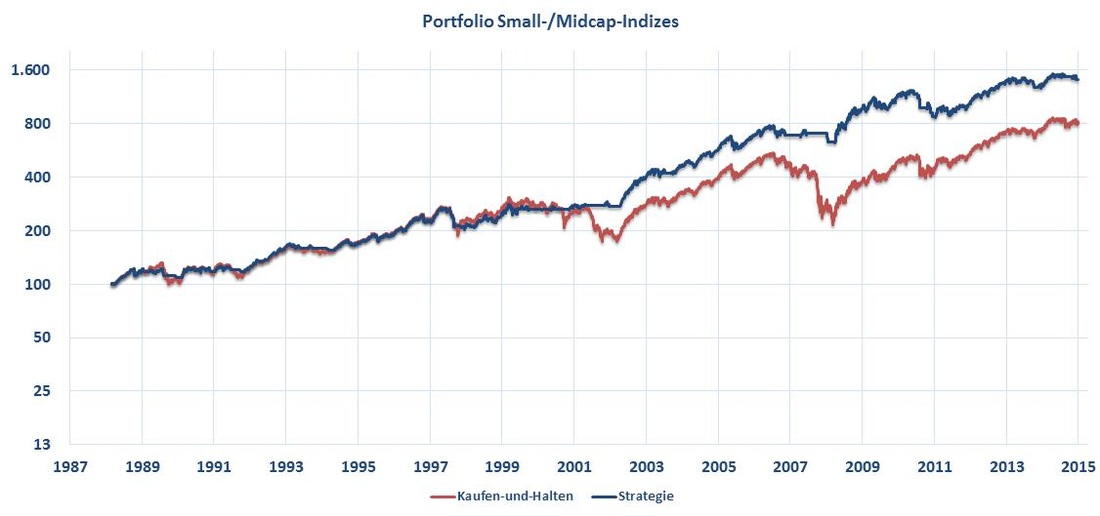

For the following backtests a portfolio of stock market indices has been applied. The simulation starts in 1929 and compares the Crash Protection strategy with a simple buy-and-hold strategy From 1929 until 1988 the portfolio consists of large cap stock market indices due to availability of data. From 1988 until 2015 a portfolio of small- and midcap indices has been applied. The results from 1988 until 2015 are additionally illustrated seperately. On each rebalance date the indices have been weighted equally. Transactioncosts are assumed to be 0.30% per trade. |

|

|

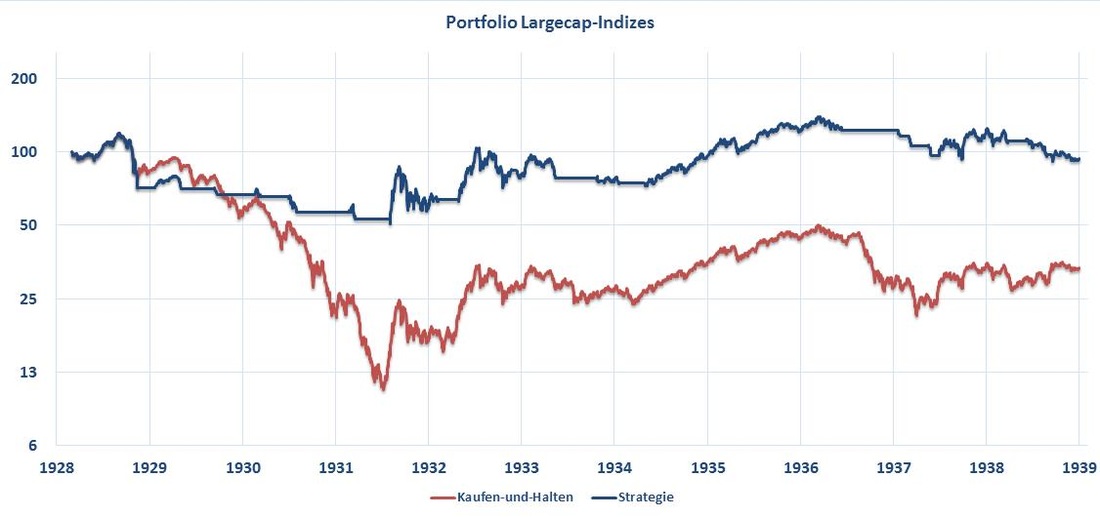

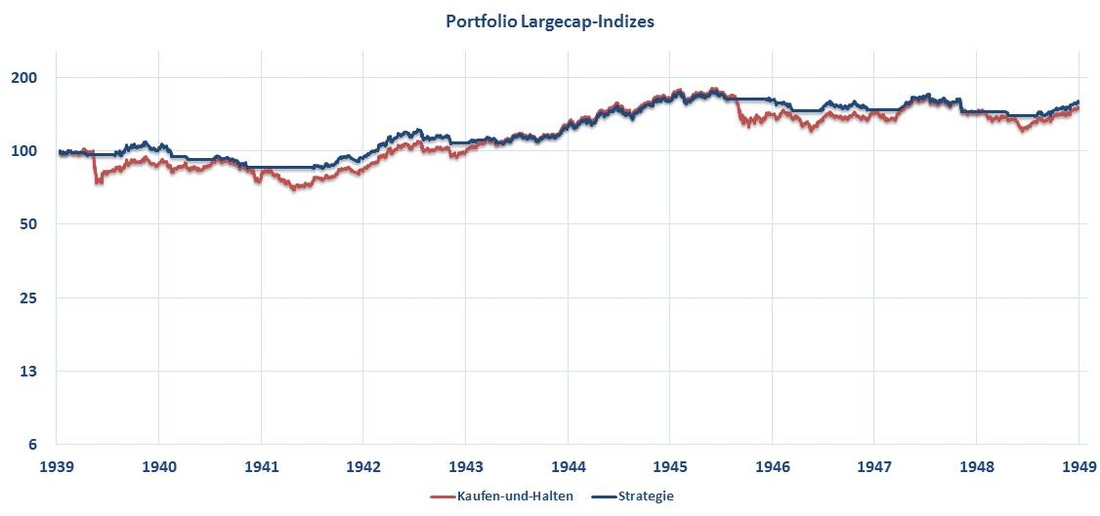

Results in different decade-long periods

Following below are the simulation results for different decade-long periods beginning in 1929. As before, until 1988 large cap stock market indices has been chosen and small-/midcap indices from 1988 on. Generally, small- and midcap indices are preferred over large indices due to higher returns over the long run thanks to a size risk premia. Nevertheless, due to a lack of data availability for these indices before 1988 large cap stock market indices have been used for these simulations. On each rebalance date the indices have been weighted equally. Transactioncosts are assumed to be 0.30% per trade. |

|