Systematic Stockpicking

Strategy

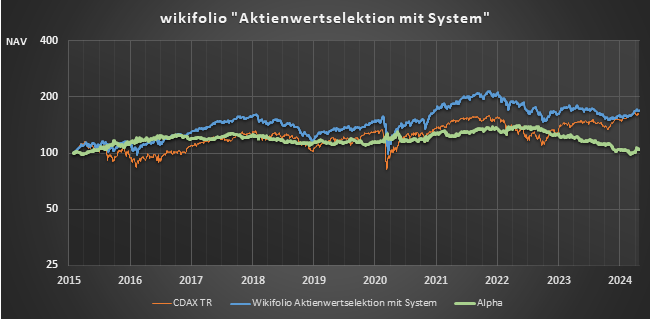

By systematically picking single stocks this wikifolio should achieve a positive alpha versus its benchmark CDAX. The stock selection could be based on fundamental and technical metrics like Price-to-Earnings/Book/Cash Flow/Sales-Ratios, Momentum, etc. Cost and liquidity restrictions might also be applied before a stock is finally picked.

By systematically picking single stocks this wikifolio should achieve a positive alpha versus its benchmark CDAX. The stock selection could be based on fundamental and technical metrics like Price-to-Earnings/Book/Cash Flow/Sales-Ratios, Momentum, etc. Cost and liquidity restrictions might also be applied before a stock is finally picked.

Leverage

Maximal gross exposure: approximately 100%

Minimal gross exposure: approximately 99%

Maximal gross exposure: approximately 100%

Minimal gross exposure: approximately 99%

Objective

Achieving a higher return as the benchmark CDAX while having approximately equal drawdown risks.

Achieving a higher return as the benchmark CDAX while having approximately equal drawdown risks.

Costs

0.95% management fee per annum

5.00% performance fee with high watermark

0.95% management fee per annum

5.00% performance fee with high watermark