Closed wikifolios

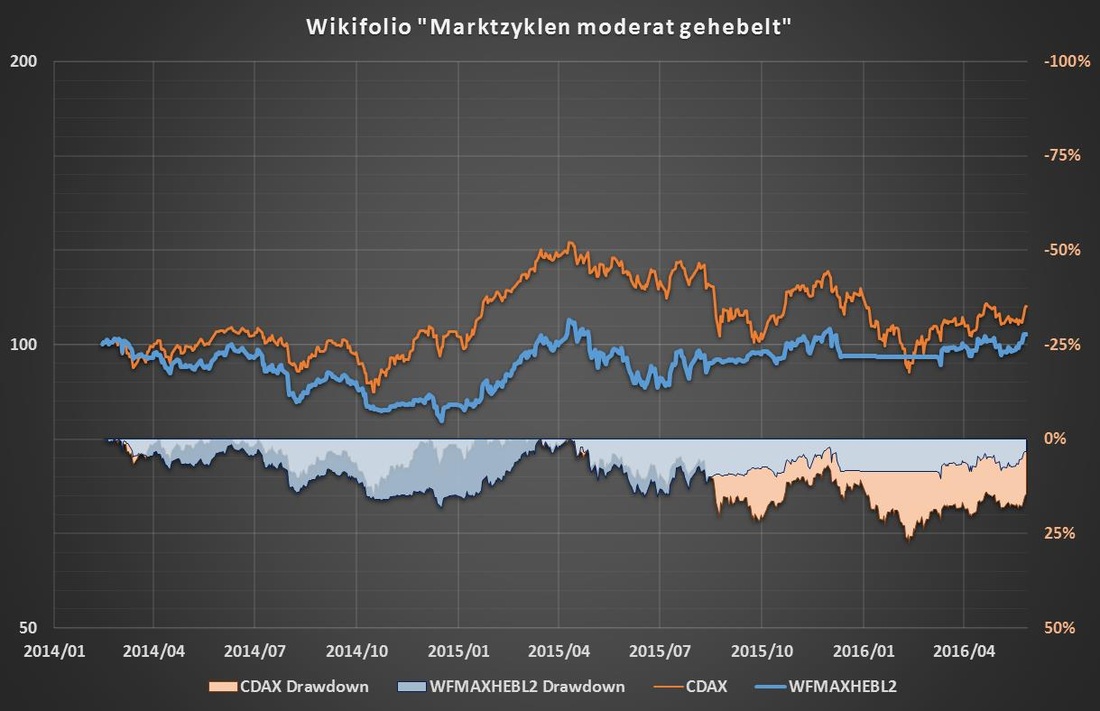

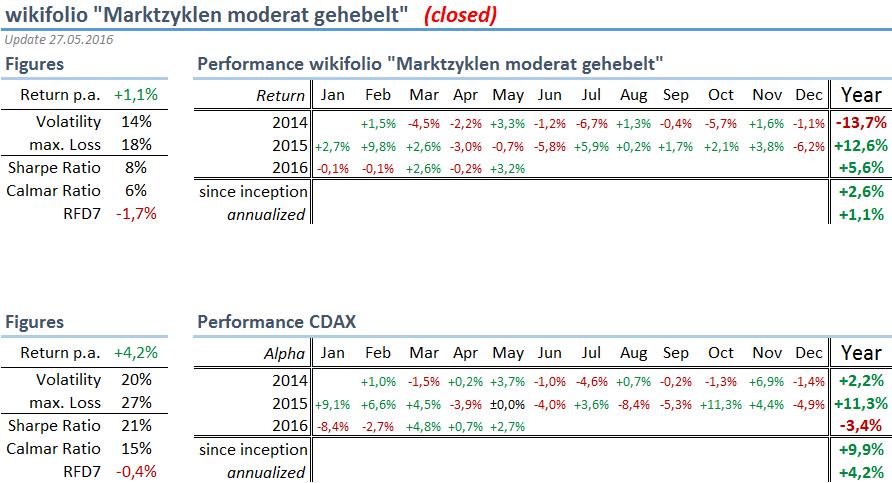

wikifolio Marketcycles leveraged moderately (closed)

In this wikifolio the Crash Risk Control-strategy has been applied with ETFs on equity market indices as base investment. Additionally a smaller portion of the portfolio has been invested in leveraged products on equity market indices. Objective has been to achieve a higher return than the market while reducing simultaneously drawdown risks.

created on 02/13/2014

closed on 05/27/2016

reason for the closure: due to a limitation of 8 wikifolios per trader this wikifolio has been replaced by "Alpha+Beta+Crash Risk Control"

In this wikifolio the Crash Risk Control-strategy has been applied with ETFs on equity market indices as base investment. Additionally a smaller portion of the portfolio has been invested in leveraged products on equity market indices. Objective has been to achieve a higher return than the market while reducing simultaneously drawdown risks.

created on 02/13/2014

closed on 05/27/2016

reason for the closure: due to a limitation of 8 wikifolios per trader this wikifolio has been replaced by "Alpha+Beta+Crash Risk Control"

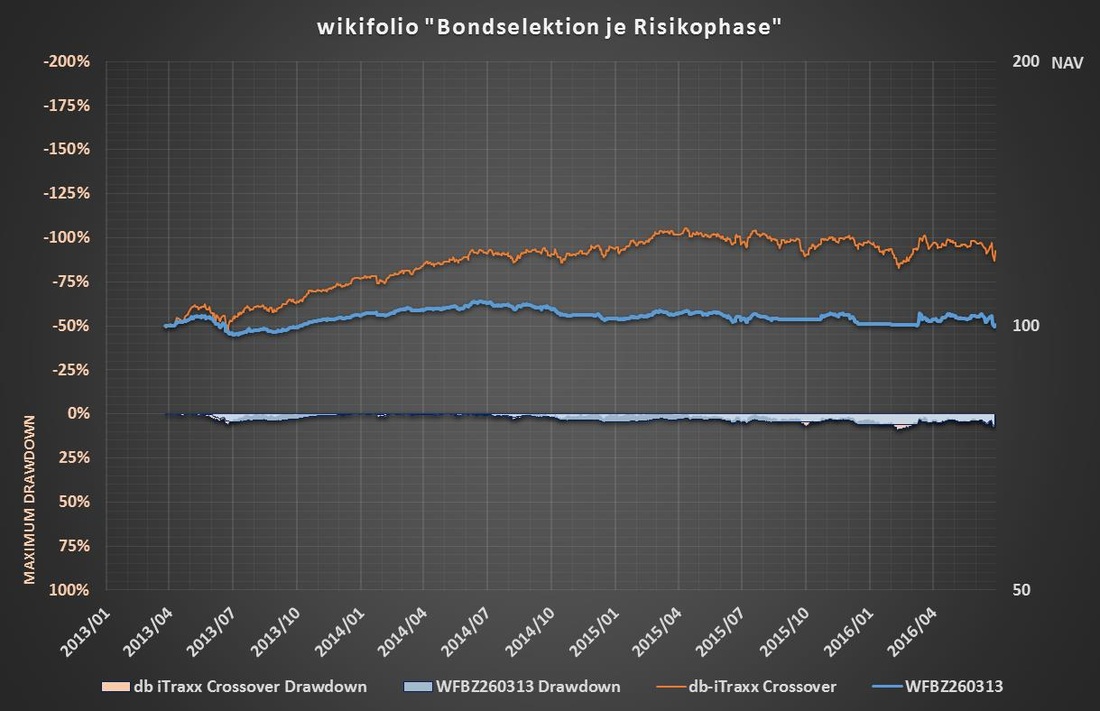

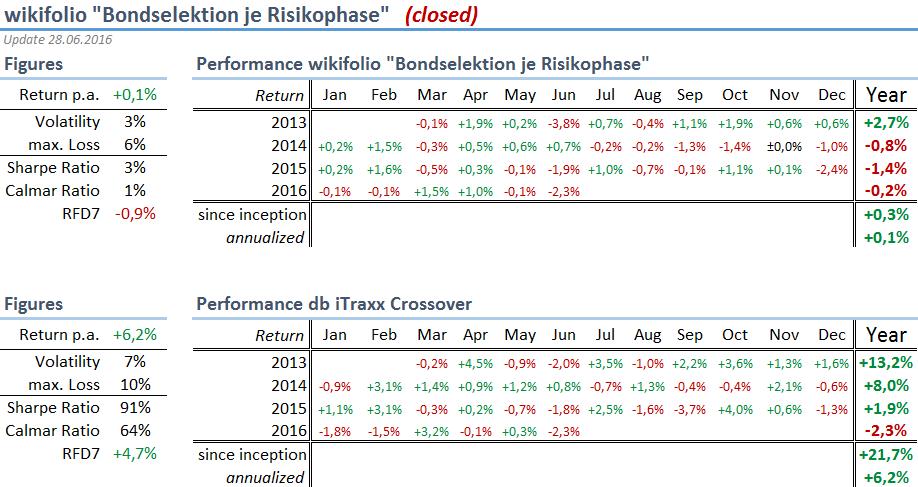

wikifolio Bondselection by Risk Period (closed)

In this wikifolio the Crash Risk Control-strategy has been applied with ETFs on high yield-bonds as base investment. Objective has been to achieve more or less market returns while simultaneously reducing drawdown risks.

created on 03/26/2013

closed on 06/28/2016

reason for closure: due to a limitation of 8 wikifolios per trader this wikifolio shall be replaced by another stockpicking strategy on european stocks.

In this wikifolio the Crash Risk Control-strategy has been applied with ETFs on high yield-bonds as base investment. Objective has been to achieve more or less market returns while simultaneously reducing drawdown risks.

created on 03/26/2013

closed on 06/28/2016

reason for closure: due to a limitation of 8 wikifolios per trader this wikifolio shall be replaced by another stockpicking strategy on european stocks.

Shown metrics

Return p.a. (annual return of the wikifolio or the benchmark)

Volatility (annual volatility of the wikifolio or the benchmark)

max. Loss (highest procentual drawdown which could have been suffered by holding the wikifolio or the benchmark)

Sharpe Ratio (ratio of the annual return to annual volatility without taking any risk free-interest rate into account)

Calmar Ratio (ratio of the annual return to the maximum drawdown)

RFD7 (the risk-adjusted annual return which would still be achieved after 7 years if the maximum drawdown would occur instantaneously)

Return p.a. (annual return of the wikifolio or the benchmark)

Volatility (annual volatility of the wikifolio or the benchmark)

max. Loss (highest procentual drawdown which could have been suffered by holding the wikifolio or the benchmark)

Sharpe Ratio (ratio of the annual return to annual volatility without taking any risk free-interest rate into account)

Calmar Ratio (ratio of the annual return to the maximum drawdown)

RFD7 (the risk-adjusted annual return which would still be achieved after 7 years if the maximum drawdown would occur instantaneously)