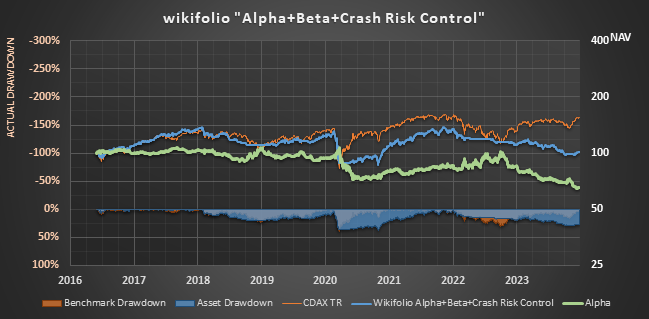

Alpha + Beta + Crash Risk Control

Strategy

In this wikifolio of wikifolios the Crash Protection-Strategy shall be realized with alpha-generating wikifolios as base investment. In the case that the Crash Risk-indicators show higher market risks all market-risk-bearing positions shall be sold or replaced by wikifolios which are assumed to achieve market-neutral returns.

In this wikifolio of wikifolios the Crash Protection-Strategy shall be realized with alpha-generating wikifolios as base investment. In the case that the Crash Risk-indicators show higher market risks all market-risk-bearing positions shall be sold or replaced by wikifolios which are assumed to achieve market-neutral returns.

Leverage

Maximal gross exposure: approximately 100%

Minimal gross exposure: approximately 0%

Maximal gross exposure: approximately 100%

Minimal gross exposure: approximately 0%

Objective

Achieving a higher return as the benchmark CDAX while having reduced drawdown risks.

Achieving a higher return as the benchmark CDAX while having reduced drawdown risks.

Costs

There are no additional costs to the ones charged by the holdings of this wikifolio of wikifolios.

There are no additional costs to the ones charged by the holdings of this wikifolio of wikifolios.